Big news from the OG of ad blocking.

Eyeo, the company which owns popular browser extensions AdBlock and Adblock Plus, is pivoting away from ad blocking into a new direction (so it says).

What next? Privacy products.

Such as?

The details are vague. But, two general areas were shared:

Blocking trackers, cookies, and fingerprinting by default at the device level

Enabling privacy-safe ad measurement using techniques like differential privacy

This refocusing is being framed as a dramatic change. Meaning: it’s not a song and dance to create attention around a fresh product. It’s a new strategic direction the company is centering around — and betting its future success on.

To illustrate this point, Eyeo refers to this move as a “strategic refounding”. This is when a company transitions to radically reimagine its mission and direction — as if it were starting from scratch, but with the assets and inertia of an existing business.

Think of when Steve Jobs returned to Apple prior to the release of the iPod, iPhone, and iPad. That’s probably the most successful example of a strategic refounding ever.

Typically it includes:

New CEO

Revised focus

Organisational restructuring

Cultural reset (back to startup mode)

That’s exactly what Eyeo have done. They’ve hired a new CEO (startup veteran Douglas de Jager), laid off 40% of their work force, and are aiming to prioritize “what truly matters to users” — protecting their privacy online. Which, they acknowledge they haven’t done a great job at to date.

You may be thinking: “Doesn’t AdBlock and Adblock Plus block trackers already!?”

No… not really. By default these extensions are opted into Acceptable Ads, which allows tracking via third-party cookies and other means. This is what helps make the ad inventory sold via Acceptable Ads attractive to advertisers.

To bring these existing products inline with the new strategic direction, tracking will be disabled on AdBlock and Adblock Plus going forward.

The boldness of this company move is admirable. It takes guts to do all this.

But, I can’t help but see it for what it is.

Eyeo lost its ad blocking leadership

Let’s rewind back to 2015.

The digital media and advertising industry went into panic mode over the sudden rise of ad blockers. Pagefair reported that 198 million people were blocking ads, a number that had seemingly risen from nowhere in no time. Growth forecasts indicated the majority of consumers would be blocking ads in a few years. Ad people lost their shit.

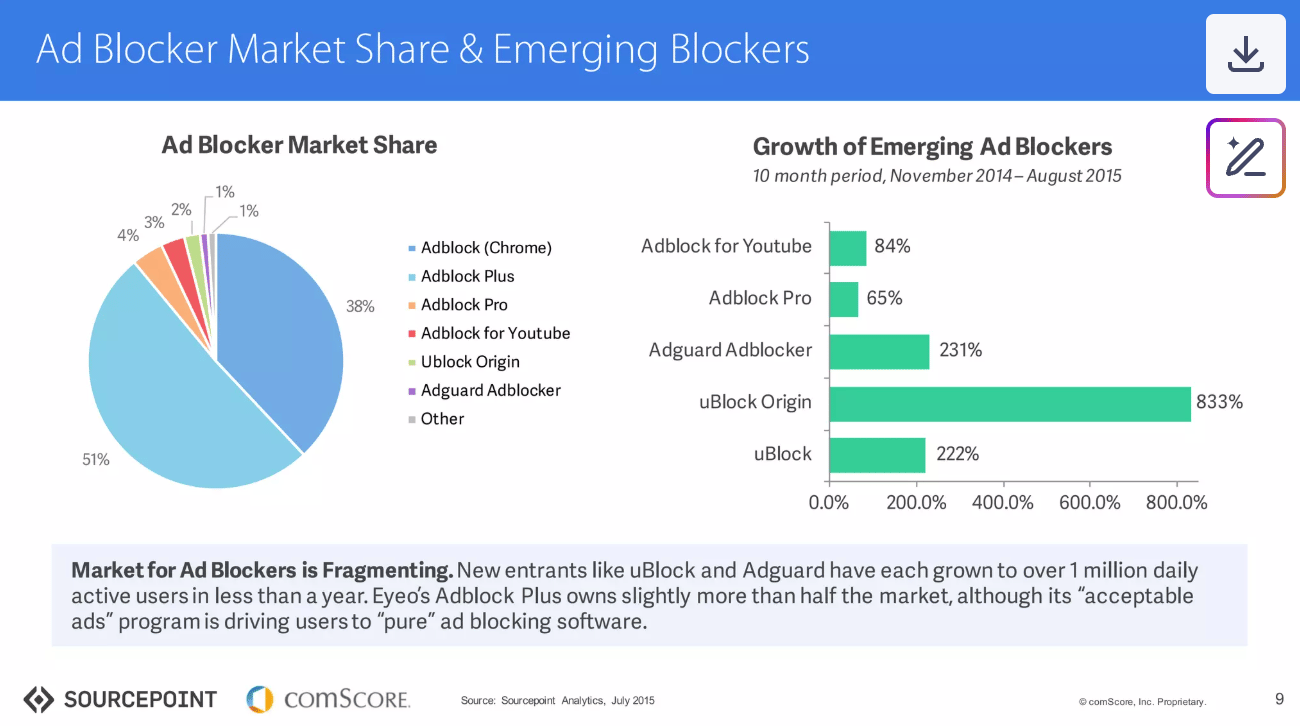

The main force behind driving ad blocker adoption? Two extensions: AdBlock and Adblock Plus. They controlled around 85% of the ad blocker market, by monthly active users.

Eyeo, which owned both these extensions, was firmly in the limelight. They held the cards and got invited to all the hot industry events — to be both attacked and hesitantly heard by the ad industry. They were divisive. But, they were relevant. On the tip of everyone’s tongues, because they represented the voice of a new generation.

But, this period also marked the beginning of the end for Eyeo. The end of their domination over the ad blocker category, that is.

Whilst Eyeo was in the spotlight basking in its newfound infamy, a new generation of ad blockers quietly grew in the corners of the tech-minded Internet. These blockers were filling a gaping void created by AdBlock and Adblock Plus.

It wasn’t rocket science. They just did what many thought an ad blocker should do:

Block ads, all the time

Block tracking, all the time.

The more effectively, the better.

That’s it.

AdBlock and Adblock Plus didn’t do that. Instead, they became the twin pillars of the Acceptable Ads program, which displayed ads to users and allowed tracking.

Other words: Acceptable Ads drew backlash and sparked the creation of competitors that rejected ad whitelisting and focused on total blocking.

This isn’t just hindsight talking. The writing was on the wall, even back then. The below slide from Sourcepoint’s “The State of Ad Blocking” report in 2015 called this out:

Some of the ad blockers named on the slide — such as AdGuard and uBlock Origin — went on to become heavy weights in ad blocking, with hundreds of millions of users. That year, they were just babies.

Check out that last line: “[The] acceptable ads program is driving users to pure ad blocking software.”

They were right.

Today, Eyeo’s share of the ad blocker market — measured by users — is less than 30%. A minority position. It’s own report from 2023 points to this. It claimed there were 912M active ad blocking users worldwide, with only 327M who were eligible for Acceptable Ads.

If we deduct the users of non-Eyeo owned products that employ Acceptable Ads, such as Opera and Aloha browsers, this figure likely drops to far less than 300M. Meaning, less than 300M AdBlock and Adblock Plus users. This translates to a sub-30% market share, even two years ago.

Things haven’t changed for the better since. User growth for Eyeo’s products has been lacklustre for years. Meanwhile, the adoption of “pure” ad blockers has grown like stonk.

This slide, from a recent report by Ad-Shield, illustrate’s this. The company refers to “pure” ad blockers as “brutal” ad blockers here:

The gravy train

But, let’s give credit where it’s due. Acceptable Ads has been a gravy train for Eyeo, delivering heaps of revenue. It’s ad blockers may be fading into obscurity, but it’s ability to monetize them has been first-class.

And this was no easy task. For years, the premise of paying the same company that blocked your ads to whitelist them was met with powerful hostility. That changed. It was adopted at scale.

How much of a gravy train, you ask?

Eyeo is a German company. It’s required to file its accounts with the German registrar.

So… I went in, downloaded the docs, and threw them into ChatGPT.

This is what it pulled out:

Year | Revenue (Euros) |

|---|---|

2014 | €4.8M |

2015 | €39M |

2016 | €31.9M |

2017 | €37.8M |

2018 | €38.8M |

2019 | €47.5M |

2020 | €55.8M |

2021 | €62.8M |

2022 | €71.2M |

2023 | €87.2M |

2024 | €86.1M |

Not bad. Not bad at all.

So, what’s the problem?

Whilst revenue has generally been up and to the right, much of this has come from monetising the user base they have, rather than growing the user base they have.

From 2014 to 2018, revenue growth came from Google and other adtech vendors joining Acceptable Ads and paying whitelisting fees. From 2018 onwards, growth was bolstered by Blockthrough's emergence, which productised Acceptable Ads inventory for digital publishers — and saw widespread adoption.

Parallel to this, the criteria for what constitutes an "Acceptable Ad" became much more liberal over time, allowing a wider variety of ads that yield higher revenue per 1,000 impressions (RPM).

The net result of all this is dollar signs. 🤑

The competitive problem

But, Eyeo’s success is also it’s failure. It pushed itself into a corner.

Reddit, the unofficial barometer of ad blocker popularity, tossed AdBlock and Adblock Plus aside a long time ago.

There’s a simple rule with the ad blocker marketplace: the more stuff you block, the more effectively, for the lowest price (free), the more users you get.

It’s a race to the bottom. Whoever blocks the most, attracts the most. That’s where early adopters are attracted, which mainstream users follow later. uBlock Origin and it’s peers outflanked Eyeo’s products by doing just this.

Today, I think of AdBlock and Adblock Plus like Facebook. It was cool when it was new, but then they “sold out” and now its the kind of thing your grandma uses.

That’s nothing to sniff at, though. It’s a good business (and profitable). My point being: in order to drive a resurgence of users to its ad blockers, Eyeo would need to ditch Acceptable Ads. That ain’t gonna happen.

To be fair to Eyeo, the lack of user growth wasn’t for a lack of trying. It invested heavily in products that offered the potential to drive a new pace of growth. For example, there was the Adblock Browser and its various attempts to block ads via AdBlock and Adblock Plus offerings within popular browsers on iOS and Android.

You can assign material blame for why these didn’t take off to the fact that iOS and Android make ad blocking deliberately prohibitive. But, that’s somewhat pointing the finger at someone else.

Brave and DuckDuckGo, for example, are seeing success with their mobile browsers that block ads. Guess what? They don’t have Acceptable Ads.

Additionally, iOS and Android have been out manoeuvred by the rise of network-level ad blocking. This is ad blocking technology that blocks ads at the network-level (e.g. via a router) before they reach a phone. Eyeo kinda slept on this — and other forms of ad blocking like VPNs.

But, all of that is kind of redundant, since if it had pursued them seriously it would have been out competed by offerings that didn’t load ads or track users.

What’s next: Acceptable Ads

Where does Eyeo go from here?

For starters, it will need to maintain its present revenue streams in order to fund the pivot. However, killing tracking in AdBlock and Adblock Plus may hamper this.

For example, the value of Blockthrough facilitated inventory will likely fall due to less signal (no cookie syncing/tracking). It was already below non-ad blocked inventory rates, this will likely make it worse.

It is also unclear how this would impact Eyeo’s deal with Google and its other adtech partners. For example, how much does Google rely upon tracking to extract ad revenue from its whitelisting arrangement, currently?

Additionally, there is also something notable by its absence in Eyeo’s press release: open web publisher inventory! It’s bread and butter.

There’s no forward looking statement laying down any kind of ambition to expand Acceptable Ads with publishers. Instead, it refers to retailers: “new partnerships with top Fortune 500 retailers, an expanded collaboration with the world’s largest e-commerce platform”.

It looks like the appetite for publisher inventory has gone. That they’ve hit market saturation, and don’t see much upside.

This shouldn’t come as a total shock.

Both AdBlock and Adblock Plus are mainly installed on desktop browsers. This is not a high-growth area. People spend the majority of their time in mobile apps. And, due to AI, the future of open web publishing looks bleak. Recovering ad blocking revenue isn’t a high priority for publishers. They got other problems.

Despite the advances Eyeo has made with Acceptable Ads, there’s still a stigma associated with whitelisting. An uncomfortable tension with paying the company that blocked your ads to unblock them. That’s an oversimplification, but the tension is there none-the-less.

This is why, a few years ago, Eyeo tried to reposition itself as a developer of “ad filtering” products as oppose to “ad blocking”. That’s no easy task when your two most popular products literally have the term “adblock” in their name.

Then there’s Manifest V3: the Chrome update that weakened ad blockers, where Eyeo has the bulk of its user base. Another force working against its interest.

In short, ad block recovery is not sexy.

But, you know what is sexy? Privacy.

What’s next: Privacy products

Which brings us back to Eyeo's "strategic refounding." The privacy pivot isn't just following trends — it's trying to escape the problems that boxed them in.

It's telling they chose AdExchanger to announce this change. They're speaking to the ad tech ecosystem, signaling this isn't a massive shift away from ads but a repositioning within it.

On the surface, the privacy direction has idealistic vibes: "consumers deserve privacy!"

Many companies have gone down this path and gone nowhere. For example, browser extensions that only block trackers haven’t been very popular. Privacy Badger has just 1M downloads in the Chrome Web Store, and Disconnect just 400K.

What's the real play here?

Well, this isn't clear. The vague details shared so far raise more questions than they answer. That's OK. They're yet to figure this out too.

But a couple of comments:

It's not clear why device manufacturers would want anti-tracking tech and pay handsomely for it... enough for it to be a big business that rivals Acceptable Ads

Helping advertisers measure performance whilst preserving privacy is a crowded space. They have tried similar ideas before — e.g. Crumbs.

The ambition for a new high-growth direction has been brewing for a while. It hasn’t just popped up overnight.

A job posting from April 2024 shows Eyeo was already considering a pivot-like expansion well over a year ago. They sought a Lead Product Manager for "Network Solutions" with the ambitious goal to "grow from 300 million to one billion ad-filtering users over the next three years."

Relevant excerpt:

Eyeo: April 2024 job post on LinkedIn

The post revealed telling details about a shift toward network-level ad blocking. This is a dramatic departure from Eyeo’s existing product lines.

Sound familiar? It echoes the new privacy-focused direction — going B2B, straight to the source to block stuff at the level of device manufacturers and networks.

Another thing that crossed my mind: is “privacy” just a trojan horse for “ad blocking”?

Adblock Analyst View

This pivot feels like a long time in the making. Eyeo made a competitive prison of its own design.

They faced two choices: hum along as they are, or go for it with something different.

They chose different.

Just how different that is, we shall see.

Adblock Analyst

The business of the ad blocking ecosystem.

Don’t miss a beat. Subscribe below.