Adblock recovery company Ad-Shield has released what it calls the first comprehensive study of "dark traffic" — ad blocker users who are invisible to widely used analytics and monetization tools.

The findings suggest the problem is both larger and fundamentally different than most publishers realize. According to the report, 976 million users — representing 18% of all web traffic — generate what Ad-Shield terms "dark traffic."

These users aren't being measured, communicated with, or monetized by publishers. Traditional adblock recovery solutions like Acceptable Ads and adblock walls are incompatible with this traffic, the report says. Which, there is strong evidence in the public domain to support.

The study's most striking claim? 57% of these users never actually chose to block ads. Meaning, addressing them would require a different approach to ad blocker users that explicitly chose to block ads. For instance, they may not have the ability to deactivate their ad blocker if asked. They may even expect to see ads. The implications of this are profound.

To get to these numbers, the study combined on-site measurement across its publisher network (5 billion page views), consumer surveys (2,616 respondents), and third-party data sources.

What distinguishes this research isn't necessarily the scale of ad blocking it depicts — many estimates have reported around one billion ad blocking users for years — but rather its focus on identifying and defining characteristics of a specific segment that demonstrate meaningful objective differences in ad blocker functionality and user intent.

Gray vs. Dark Traffic

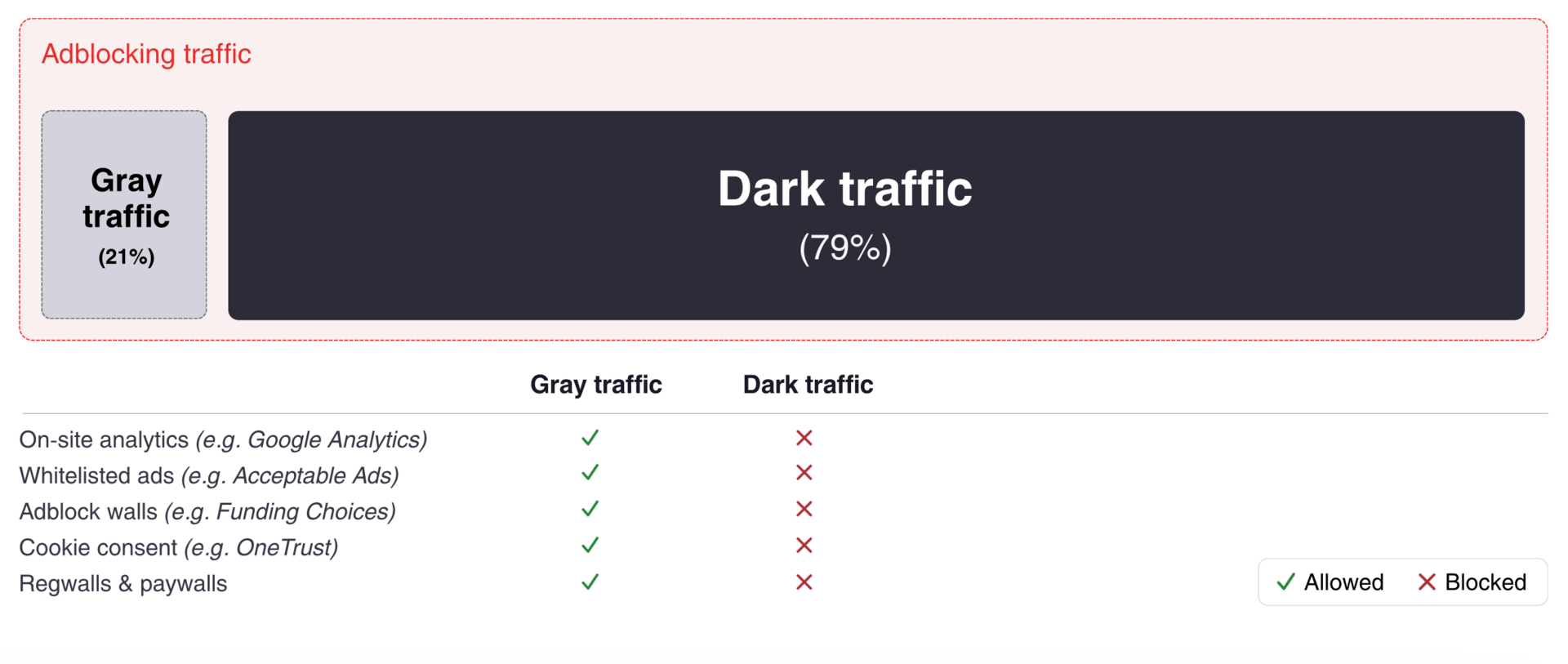

Ad-Shield's research centers on a taxonomy that splits ad blocking into two categories: "gray traffic" and "dark traffic."

Gray traffic comes from traditional ad blockers like AdBlock Plus. These tools block ads but leave three key functions intact: they allow analytics tracking, they permit whitelisting (e.g. Acceptable Ads), and they let publishers show messages asking users to disable their ad blocker.

Dark traffic, by contrast, comes from what the company calls "brutal" ad blockers — tools that deprive publishers of any revenue generation capabilities, such as ads, analytics, adblock walls, cookie consent banners, and paywalls.

This binary distinction, while useful for Ad-Shield's business model, highlights a genuine evolution in the ad blocking landscape that extends beyond browser extensions to encompass VPNs, network-level blocking, and browsers with built-in ad blocking features.

Today, there are hundreds of ad blockers that each block different publisher elements in different ways, demonstrating the trend of a race to the bottom of blocking more publisher features over time.

Fragmented Ecosystem

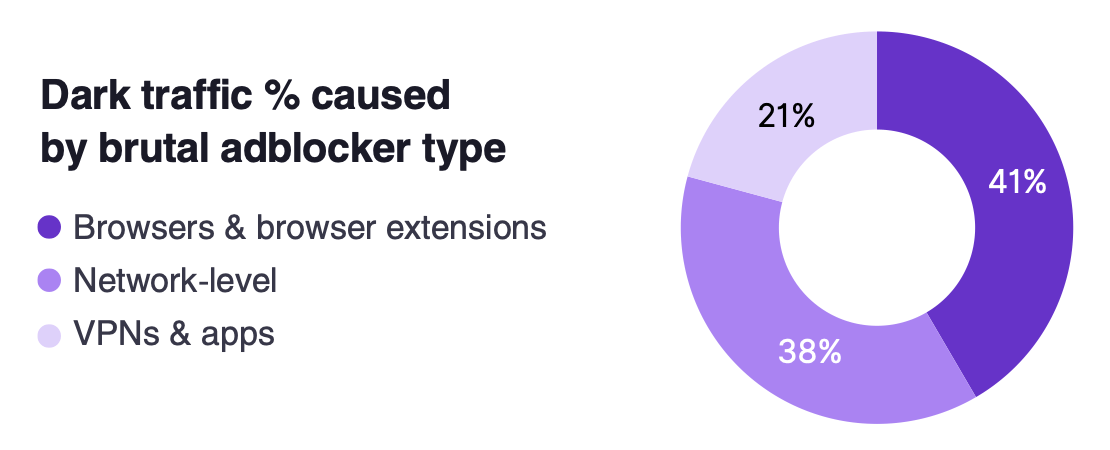

The research puts numbers on a fragmented ecosystem that we have long suspected: ad blocking has evolved far beyond the browser extension model dominated by AdBlock Plus. Ad-Shield's data provides the figures on how dark traffic is distributed across channels:

Browser-based tools (41%)

Network-level blocking (38%)

VPNs and apps (21%)

This fragmentation presents a much more complex challenge for publishers than the era of AdBlock Plus dominance. Each type of ad blocker has a different philosophy and set of functional capabilities. Meaning, addressing them all requires a nuanced approach and robust technical capabilities.

Users Aren't Aware They're Blocking Ads

The research's most significant finding concerns user awareness: 57% of dark traffic users never made the decision to block ads. Instead, ad blocking is being activated by third parties without users' knowledge or consent. This is a shocking find, and is much higher than existing assumptions concluded.

According to Ad-Shield's data, 38% of dark traffic comes from network-level blocking — systems deployed by workplaces, schools, and public WiFi providers. Additionally, IT departments and cybersecurity teams are installing ad blockers directly on devices, converting users to dark traffic without their awareness.

The company says this institutional adoption has been accelerated by cybersecurity recommendations from organizations including the FBI, which has publicly endorsed ad blockers as a security measure. What began as individual consumer choice has evolved into enterprise IT policy that operates invisibly to end users.

While the 57% figure is higher than expected, the degree of user unawareness is supported by a well-documented shift of IT managers and cybersecurity professionals taking steps to block ads within the institutions they work for.

Mobile Shift

The report claims dark traffic is now 53% mobile, challenging the long-held assumption that ad blocking is primarily a desktop phenomenon.

This shift reflects the proliferation of mobile browsers with built-in ad blocking (Brave, DuckDuckGo), VPN services that include ad blocking features, and network-level blocking that affects mobile users on corporate or public WiFi.

Geographically, the highest concentrations are in Western markets: Germany (34% of total traffic), France (32%), UK (23%), US (21%), and Canada (23%). These figures suggest ad blocking has moved well beyond tech-savvy early adopters to mainstream audiences.

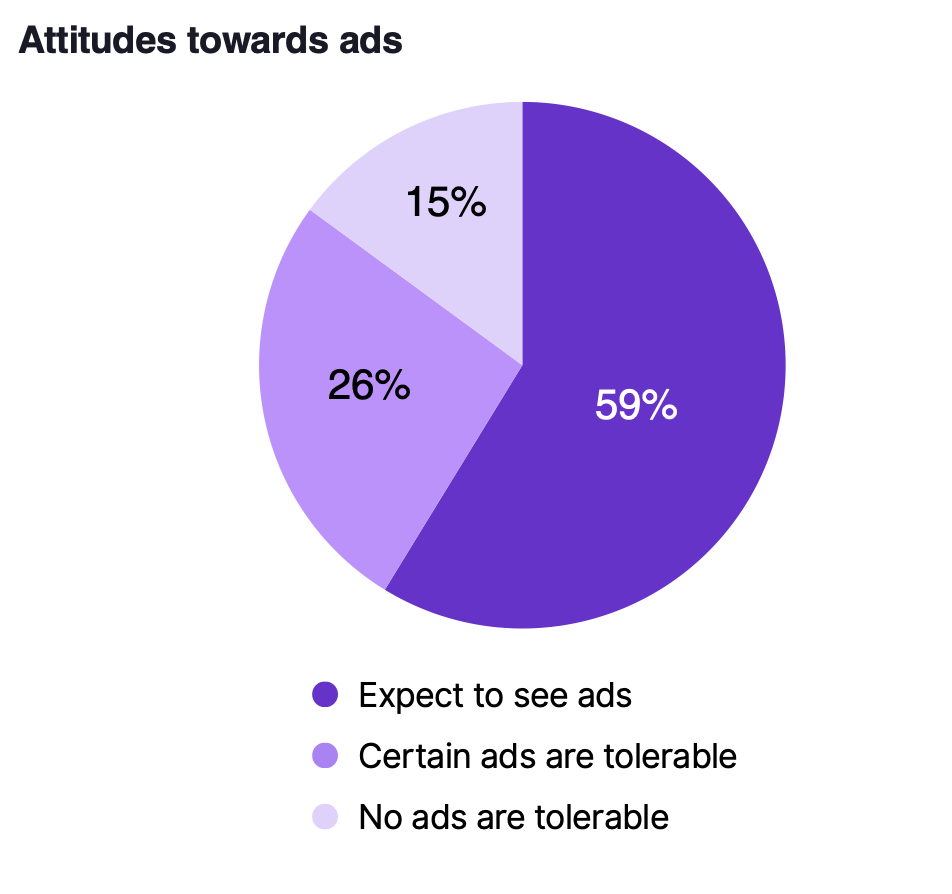

59% Expect To See Ads

Ad-Shield's consumer research suggests a disconnect between what brutal ad blockers do and what their users actually want. The company claims 85% of dark traffic users either expect to see ads OR find certain types of ads tolerable, with only 15% categorically opposed to all advertising. This is quite possible, if we accept the premise that the majority of dark traffic is unaware they are blocking ads.

Among users who did actively seek out brutal ad blockers, YouTube pre-roll ads were cited by 51% as their most frustrating ad experience — a finding that aligns with broader industry observations about YouTube's role in driving ad blocker adoption.

Publisher Impact

For publishers, the implications are stark. According to Ad-Shield's measurements across dark traffic page views in its network:

100% block ads (no whitelisted ads allowed)

62% block analytics

51% block adblock walls

26% block cookie consent banners

The company estimates this is costing publishers 18% of their potential revenue — a figure that is based on the ratio of dark traffic page views to total page views (they say 18% of web traffic is dark traffic).

Ad-Shield claims traditional ad block recovery mechanisms are ineffective against dark traffic. Publishers can't measure these users through standard analytics, can't communicate with them through adblock walls, and can't monetize them through Acceptable Ads.

There's strong evidence supporting these claims. For example, Acceptable Ads is only compatible with ad blocking software that eyeo — the company that administers the whitelisting program — owns or has partnership agreements with. The main examples here include AdBlock, Adblock Plus, and Opera's built-in blocker. Together, these represent a minority of the ad blocker market by page views, a fact that eyeo itself acknowledges.

For instance: In a 2023 report, eyeo claimed there were 912 million active ad-blocking users worldwide, with only just over 300 million participating in Acceptable Ads. Meaning, over 600 million is dark traffic that falls outside the scope of Acceptable Ads monetization.

Industry Implications

Ad-Shield's findings suggest that most publishers are addressing only about 21% of their ad blocking problem through traditional recovery tools. The majority of ad blocking traffic operates in a layer that's invisible to standard measurement and recovery systems.

For advertisers, this represents a significant audience that's effectively unreachable through traditional digital advertising channels. For publishers, it's a revenue stream being blocked by systems their audiences may not even know exist.

The findings also provide context for the Manifest V3 transition. If most ad blocking happens through browsers, VPNs, and network-level systems rather than traditional extensions, then changes to Chrome's extension architecture address only a minority portion of the ad blocking problem for publishers.

Adblock Analyst View

The report reflects a fundamental shift in the ad blocking landscape. The move from individual consumer choice to institutional policy, combined with the proliferation of ad blocking across multiple platforms and services, highlights the industry is dealing with a more complex challenge than traditional ad blocking. To be honest, this fact is not new and is well documented.

However, what Ad-Shield has brought to the table with this report is facts, figures, and framing. Quantifying it in actionable terms for the first time.

Whether the industry adapts to this new reality or continues optimizing for traditional ad blocking scenarios may influence the future viability of many digital publishing business models.

For publishers, the pressing question isn't whether these numbers are precisely accurate, but whether they're directionally correct. And, I can tell you they are. Make your decisions accordingly.

To check out the full report for yourself, head here.

Adblock Analyst

Analysis on the business of the ad blocking ecosystem.

Don’t miss a beat. Subscribe below.